Getting your tax return work papers in order doesn’t have to be confusing. When you know what to gather and how to organize it, the process becomes much simpler and less stressful. Preparing ahead can help reduce errors and give you more control over your financials. Instead of scrambling at the last minute, you’ll have everything you need ready to go. That means fewer delays and a smoother path toward filing.

Well-prepared tax paperwork also gives your tax preparer (or you, if you’re taking the first steps yourself) a clearer snapshot of your year. It helps ensure all eligible deductions are considered and reduces the chances of missing something important. Think of it like packing for a trip. The better you prep, the smoother the journey.

Gather Necessary Documents

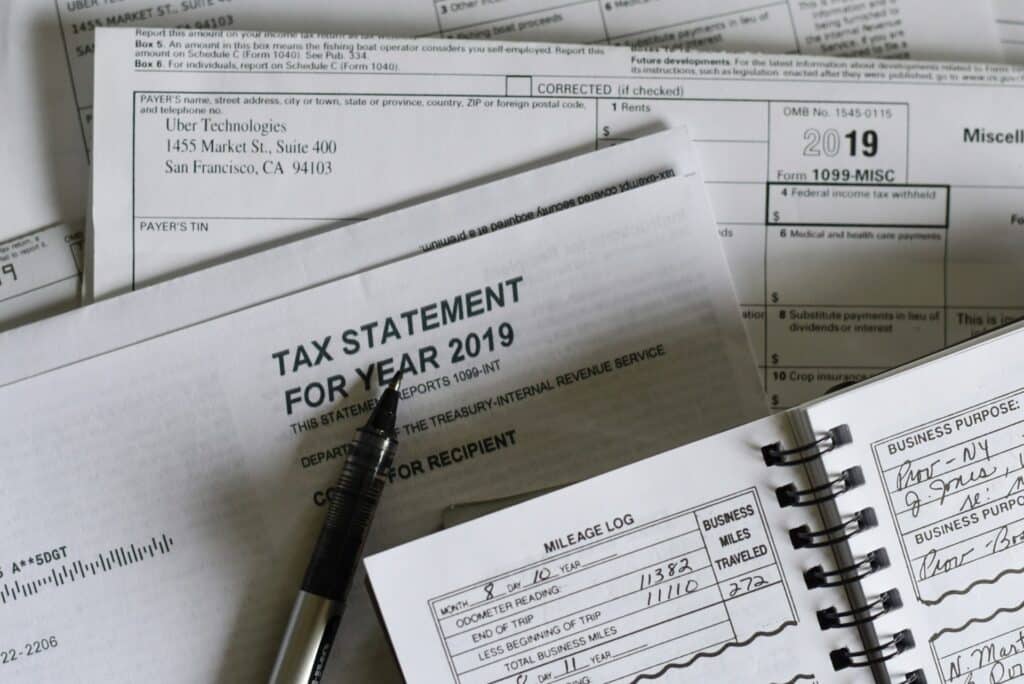

Start strong by pulling together all the documents that reflect your income, expenses, and other financial activities over the past year. If you’re not sure where to begin, here’s a helpful list of the paperwork you’ll likely need:

– Income statements such as W-2s, 1099s, or other self-employment records

– Business expense records including invoices, receipts, and digital payment logs

– Last year’s tax return, to use as a reference

– Bank statements and credit card statements

– Proof of charitable contributions, if applicable

– Loan statements, including interest paid

– Any documents related to assets bought or sold

As you collect these, set up a system that lets you track categories quickly. Use folders or digital labels like income, expenses, assets, and loans. It’ll help you stay organized and make it easier to spot missing info. If you’re handling both business and personal finances, keep them separated from the beginning.

One example is if you’re self-employed and made some big purchases for your home office. If you toss those receipts into a general folder, finding and proving those deductions later will take more time. But if you label and store them under home office equipment, they’ll be easier to access and account for.

This step may take a little time upfront, but you’ll save way more time on the back end.

Accurate Data Entry

Once all your documents are in place, it’s time to plug in the details. Accuracy matters here. A small typo or missed number can affect your final tax outcome or trigger extra review from tax authorities. To keep things clean, enter data methodically. Start with income, then move on to expenses, then handle any remaining categories like interest or depreciation.

Here are a few smart tips:

– Double-check math and totals before moving on to the next item

– Use clean, consistent descriptions for each expense or payment

– Enter data in the same format across all categories

– Avoid rounding amounts unless absolutely necessary

Watch out for common oversights like entering a payment twice or missing one altogether. If you’re working off of credit card and bank statements, cross-reference everything to catch gaps. Mistakes like mixing up personal expenses with business ones can also cause headaches. Keep those completely separate, especially if you’re itemizing deductions.

Being slow and steady here pays off. Accurate records now mean fewer corrections later and more peace of mind when it’s time to file.

Reconcile Accounts

To get everything in line, you’ll want to reconcile your bank accounts, credit cards, and other financial records. This step is like matching puzzle pieces to see the big picture. Begin by gathering all your statements from banks and card companies. As you review each entry, check them against your records to confirm they align.

When reconciling:

– Make sure deposits and withdrawals match your records

– Identify and resolve any discrepancies right away

– Look over any unclear transactions and categorize them properly

– Regularly check for additional fees or charges you might have missed

Ensuring that your records reflect reality will prevent headaches down the road. If you spot a misstep, handle it immediately to keep your records neat. Taking time to match everything accurately will aid a smoother filing finish line.

Review and Double-Check

Before you call the paperwork done, give it a thorough review. Create a checklist to ensure you’ve covered every corner. Root out errors like skipped sections or incorrect math. If something seems off, trace it back and fix it. Take the opportunity to verify everything, from dates to amounts, for completeness.

Here’s a handy checklist for your final sweep:

– All documents and entries accounted for and in the correct category

– Verify all calculations and totals

– Check the consistency of document formats and descriptions

– Ensure no duplicate files or records included

– Confirm the use of the latest financial statements

By taking these steps, you lessen the chance of overlook. Small errors fixed now can spare you time and trouble when deadlines loom. Having a friend or colleague review the documents might catch things you’ve missed.

Compiling and Maintaining Your Records

As you finalize, neatly organize everything for easy access. Clearly label files, and consider using both physical folders and digital backups. Consistent maintenance of these records ensures you’re prepared for any future needs or compliance checks.

Why is this important? When tax season rolls around again or if an auditor comes calling, having a solid, well-maintained record saves you hassle. Plus, it keeps your peace of mind intact knowing that you’re always ready. Good preparation today sets you up for success tomorrow.

Ready to Tackle Tax Return Work Papers?

If prepping tax documents still feels overwhelming, that’s perfectly normal. Many business owners reach a point where doing it solo just isn’t worth the time or risk. Asking for help can make filing faster and more accurate, all while giving you back your focus to run your business.

Cloud Bookkeeping takes the guesswork out of tax return preparation. Our team knows how to get your papers in shape, spot issues early, and help you avoid delays or penalties. Whether you run a small shop or work independently, your finances deserve the same level of care you give your day-to-day operations.

Don’t wait until a deadline is breathing down your neck. Let’s make your next tax season feel more like a routine step than a stressful scramble.

Frequently Asked Questions

How long should I keep my tax return work papers?

Keep your records for at least three years. If your return involves claims for a loss or you omitted income, hold onto them for up to seven years.

Do I need to separate business and personal documents?

Yes, keeping business and personal financial records separate makes the preparation process smoother and helps avoid confusion or errors.

What happens if I forget to include a document?

Missing documents can lead to delays or amended returns. Do a detailed review and double-check your checklist before finalizing anything.

Is it okay to store tax records only online?

Digital copies are fine as long as they’re stored securely and backed up. Use encrypted storage or trusted cloud services with multi-factor authentication.

Can I prepare my tax return work papers on my own?

You can, but having a professional do it minimizes the risk of errors and missed deductions. It’s a smart step for accurate tax reporting.

To simplify your tax return preparation and make sure everything is accurate from the start, consider getting professional support. At Cloud Bookkeeping, we make the entire process easier by doing the heavy lifting for you. Learn how our tax return preparation services can help you stay organized, meet deadlines, and file with confidence.