Latest Posts

Monthly sales tax reports can feel like something that sneaks up right when you’re already short on time. Most small business owners know they need to…

Getting ready for business tax preparation can feel a bit overwhelming. After months of tracking clients, projects, and day-to-day expenses, it is easy for those financial…

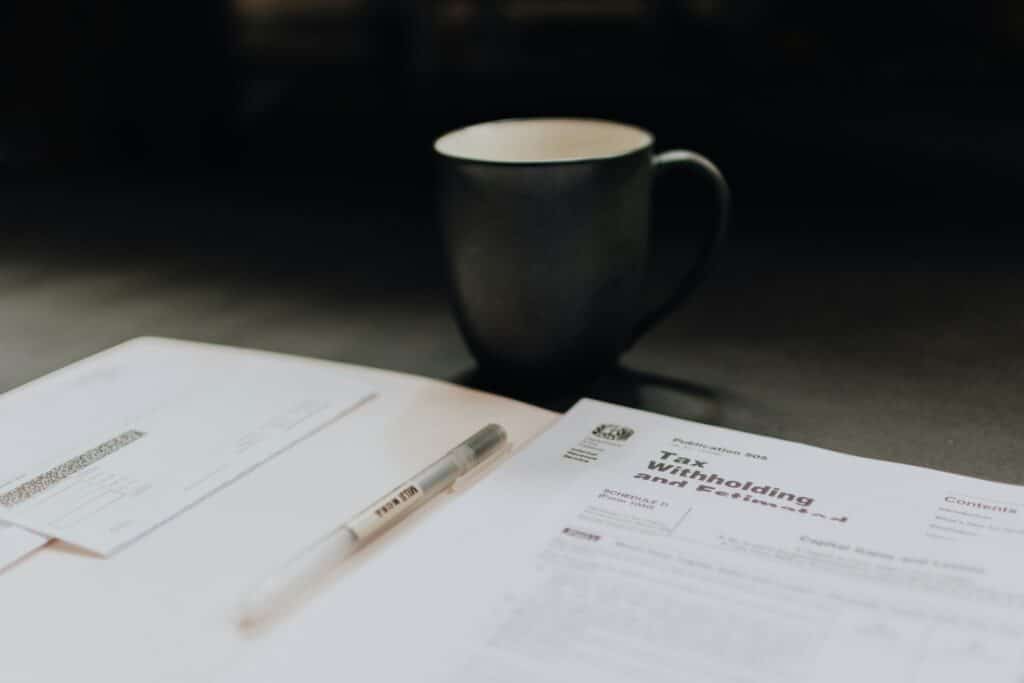

Tax planning isn’t just something you do once a year, and it’s not about filling out forms. It’s really about being smart with timing, money choices,…

When work picks up, bookkeeping tends to take a backseat. Clients are calling, emails are stacking up, and the last thing anyone wants to do is…

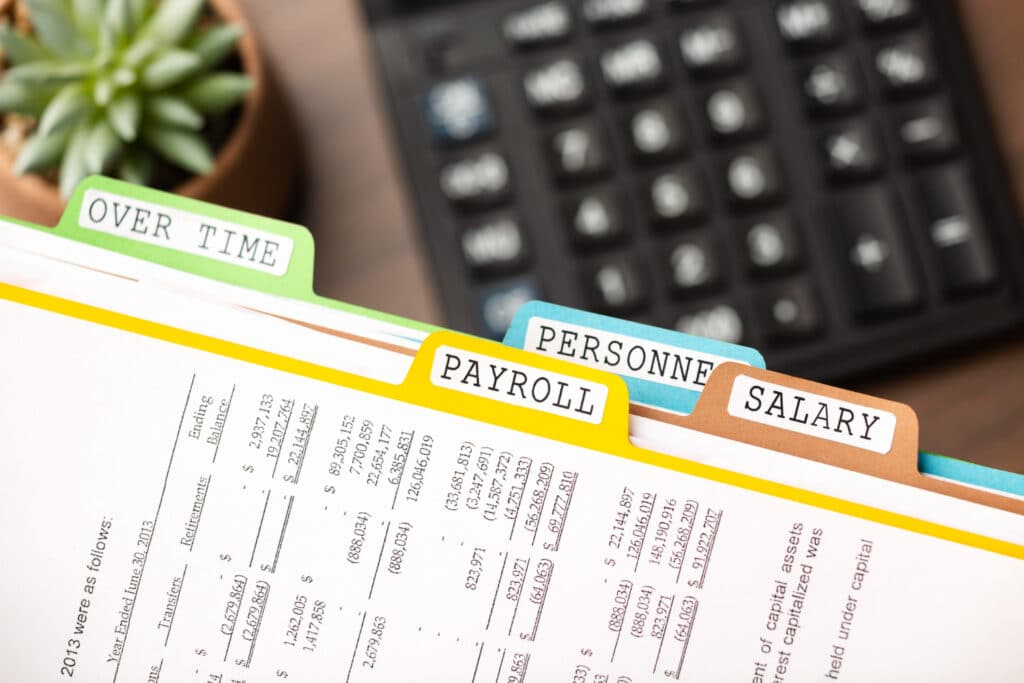

Running payroll once a week can feel like you’re always under pressure. The deadline comes around fast, whether you’re ready or not. If one small thing…

Getting ready for tax season does not have to feel like a mad dash toward the finish line. When we get started early with tax return…

Managing payroll taxes on time can feel like one more thing stacked on an already full plate. Between keeping your business running, supporting your team, and…

Staying on top of bookkeeping matters a lot when you’re running a small business. Things can get messy fast if you’re juggling receipts, bills, and paychecks…

Monthly bookkeeping does not have to be a constant source of stress. The IRS provides guidance on business recordkeeping, so when you set up a workable…

Keeping payroll records organized can make a big difference for small businesses. When all the numbers line up, it’s easier to pay employees right on time,…

Running a business across multiple states sounds exciting, but it often feels more like a juggling act. Different rules, different deadlines, lots of paperwork–it adds up…

Getting a sales tax return in Texas matters more than it may seem at first. For small business owners, it’s not just about sending in figures…

As tax season gets closer, we all start thinking about what needs to be finished and filed and whether the numbers on hand are actually right.…

Payroll processing can feel pretty straightforward until something slips. Then you’re left sorting through late paychecks, tax notices, or error-filled records. A lot of small business…

Good bookkeeping services matter more than most people realize. When records are kept clean and up to date, everything just feels more doable. Bills don’t pile…

Running payroll might not feel like a big job when your team is small, but it adds up quickly. From making sure everyone gets paid on…

Winter can feel like it slows everything down, which, surprisingly, can be one of its biggest advantages for business owners. When the busy season winds down…

As the year draws to a close, small business owners are working hard to wrap up projects, approve time off, and get their numbers in order…

Getting your books ready at the end of the year might sound like a lot, but it doesn’t have to be stressful. If we take a…

Quarter four can feel like a blur. Between holiday schedules, final orders, last-minute spending, and preparing for the new year, it all starts to snowball. We’re…

As the year winds down, payroll tends to get more complicated than usual. Between final pay runs, holiday bonuses, and planning ahead for taxes, it’s a…

The holiday season can be a wonderful time to rest, reconnect with family, and reflect on the year. But if you run a business, December might…

Filing a sales tax return in Texas can feel like a low-priority task in the middle of winter. But if you run a business here, keeping…

Payroll might not be the flashiest part of running a business, but it’s one of the most important. Making sure your team is paid correctly and…